There are many forms of unsecured loans when you are in need of capital or have financial difficulties, and the form of borrowing money with a Viettel sim is not a strange form. The information in this article will provide you with a complete guide on how to borrow money with a genuine Viettel sim card. Let's read the article together.

Main content

What is Viettel sim loan?

Borrowing money under Viettel sim is a form of online loan for customers who are owners of Viettel sim subscribers.

This is a form of unsecured loan, so the borrower does not need to mortgage the property, and also does not need to prove income or need the guarantee of relatives.

The form of lending according to Viettel sim is applied to customers who need to borrow money online quickly across the country, with simple conditions, just need ID card and household registration book with Viettel sim number to qualify for a loan.

When borrowing money with Viettel sim, customers will quickly receive the amount they want to borrow within 12 hours. Because the lender does not have to come to your home address to verify the loan application.

Advantages when borrowing money with Viettel sim?

Attractive benefits when you borrow money according to Viettel sim such as:

Maximum loan term is up to 50 million VND.

Flexible loan term from 6 to 36 months.

Right to pay off the loan at any time.

Simple loan application, get loan after 12 hours.

Do not go to the appraiser.

Extremely low interest rates from only 1.5%/month.

Free loan application fee

Interest rate applied when borrowing money with Viettel sim

Currently, interest rates for online loan packages with Viettel sim have 3 different levels. Whether the interest is high or low depends on the amount and duration of the loan. As follows:

Support level 1: The sims are only supported to borrow a maximum of 25 million and a minimum of 10 million. With this rate, the applicable interest rate is 2.95%/month and installments within 24 months.

Support level 2: This is the case where the sims are supported to borrow from 10 to 40 million VND, the loan term is 24 months and the interest rate is only 2.17%/month.

Priority 3: For customers with a maximum loan support of VND 50 million, installments in 24 months and applied with the lowest interest rate of 1.4%/month.

Instructions to borrow money with Viettel sim

Below are the conditions for borrowing money with Viettel sim.

Conditions to borrow with Viettel sim card

Customers who want to borrow money under Viettel sim must satisfy the following conditions:

Customers owning Viettel sim, Viettel subscribers.

The customer has no bad debt.

In case of late payment or outstanding debt, the loan is still allowed.

Customers are supported to borrow up to 50-70 million VND, flexible loan period from 6 months to 36 months; Minimum loan period is 6 months ie you are required to borrow from 6 months or more.

The maximum loan term is 36 months (3 years) this is the maximum period of the contract and we are also entitled to pay off the loan at any time.

If you live in a household registration or temporary residence, you are eligible for a loan; receive loan after 12-24 hours; Do not go to the appraisal house and free of charge for loan applications.

Viettel loan documents

When borrowing money under Viettel sim, you need to prepare the following documents:

3×4 photo taken in the last 3 months

Valid ID card or citizen identification card

Original viettel sim, activated and in use.

Household registration book (Photocopy of the whole book, including pages without words) can be replaced with KT3/Driver's License/…

In order to increase the loan limit and reduce the interest rate, please provide:

Minimum 12 month labor contract

Confirmation of work at work

Bank statement/Salary confirmation for the last 3 months

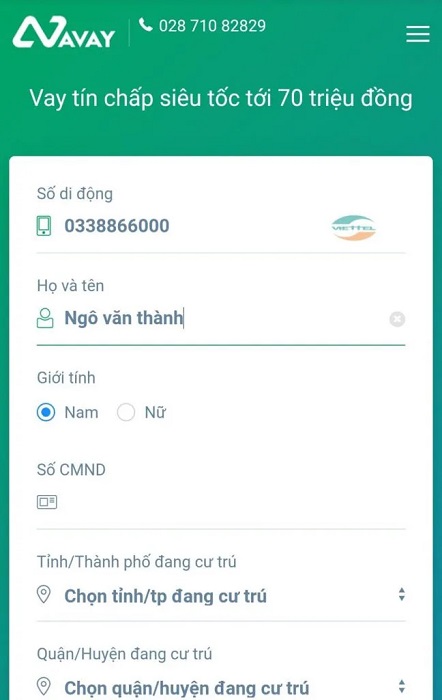

Apply for a loan with a Viettel sim card

Currently, Avay site is also supporting quick loans with Viettel sim without proof of income. Avay has no information about supporting other carriers such as Mobifone, Vinaphone...

Note: in order to easily be disbursed according to the form and procedure to borrow money from Viettel, you should use a sim card that has been used for 2 years, preferably from 5 years. You should also use the official sim card to borrow.

Credit institutions lend money according to Viettel sim

Currently, banks do not lend according to Viettel sim. If you read the advertising information to borrow money under Viettel sim at banks, you should be careful because currently there is no bank to support this type of loan.

| Đối tác | Lãi suất | Hạn mức | Thời hạn | |

|---|---|---|---|---|

| 18 – 36% | 1 triệu - 80 triệu | 36 tháng | ĐĂNG KÝ VAY |

| 24 – 36% | 10 triệu - 60 triệu | 6 – 36 tháng | ĐĂNG KÝ VAY |

| 12 – 13.2% | 5 triệu - 1 tỷ | 3 – 12 tháng | ĐĂNG KÝ VAY |

| 24 – 36% | 5 triệu - 50 triệu | 3 – 36 tháng | ĐĂNG KÝ VAY |

| 37 – 66% | 70 triệu | 12 – 36 tháng | ĐĂNG KÝ VAY |

As for financial companies such as Avay, Home Credit, Fe Credit, HD SAISON, Mcredit..., in addition to the official Viettel sim, customers need to provide more ID cards and household registration books.

These are required documents, which customers must provide to financial institutions to borrow money in this form.

However, loans at these credit institutions can take up to 2 days to be disbursed, so if you need money urgently, it will not be processed.

In addition, there are also websites or apps with links, there will be a form of lending according to Viettel sim.

Refer to the website to borrow money online just need ID card

| Đối tác | Lãi suất | Hạn mức | Thời hạn | |

|---|---|---|---|---|

| 14.2 – 14.6% | 500 ngàn - 18 triệu | 3 – 6 tháng | ĐĂNG KÝ VAY |

| 18.3% | 1 triệu - 10 triệu | 3 – 6 tháng | ĐĂNG KÝ VAY |

| 18 – 20% | 500 ngàn - 10 triệu | 1 tháng | ĐĂNG KÝ VAY |

| 12% | 3 triệu - 15 triệu | 3 – 6 tháng | ĐĂNG KÝ VAY |

| 12 – 18.25% | 1 triệu - 10 triệu | 3 – 6 tháng | ĐĂNG KÝ VAY |

Although this is a way to help you borrow money quickly, you should pay attention to choosing a reputable loan place to avoid risk or being dragged into a debt cycle, and also need to consider your financial ability before applying for a loan. get a loan.

Conclude

Above is the necessary information about borrowing money with Viettel sim, hopefully can help you get more useful information. Borrowing money with a Viettel sim is simple and fast, hopefully you will be able to get the desired amount to use for clear spending purposes.

Post a Comment